Livery business rides to victory against taxman

Business Property Relief is provided under Section 104 of the Inheritance Tax Act 1984 and if applicable gives substantial tax concessions to relevant business assets in the estate of a deceased person.

The important distinction is whether assets are relevant business property or alternatively investment property. This debate has been running for several years in respect of property such as bed-and-breakfast accommodation, caravan and chalet parks, and has now applied to an equine business.

The case of the Commissioners for Her Majesty's Revenue and Customs versus the personal representatives of the estate of Maureen M Vigne was considered by the upper tribunal of the Tax and Chancery Chamber which gave its judgment in October.

The decision of the first tier tribunal was that the livery business in question was more than simply an investment in land with receipt of the rent and effectively there were multi-facets to the provision of the livery services. The HMRC Commissioners did not agree and appealed.

There are several types of livery business and each business has to be viewed on the facts of the way in which it provides services and additional benefits over and above receiving investment income.

In the present case where there were no stables, in addition to the usual grass keep the owners of the business provided worming products (and the actual worming of the horses on a quarterly basis), hay feed during the winter months, the removal of horse manure from the fields, and a daily check of the general health of each horse.

There were multi facets to the carrying on of this business.

The upper tier tribunal shed interesting light on what needs to be considered and the approach taken in deciding whether Business Property Relief is available. The tribunal commented: "There is no clear bright line between businesses which qualify for the relief and those that do not. We are satisfied that the first tier tribunal applied the correct legal test and that the conclusion it reached was one which it is entitled to reach on the basis of the evidence before it"

It is anticipated this case will be followed by more to come. It is however clear that in order to gain the Business Property Relief there has to be substantial multi faceted involvement by owners in the running of the business to avoid the assets being judged as investment property alone.

In terms of value if, for instance, the property in the above case comprised 30 acres of agricultural land with no buildings and was valued at £300,000 then the inheritance tax saving if Business Property Relief applied could be in the region of £120,000 in the right circumstances.

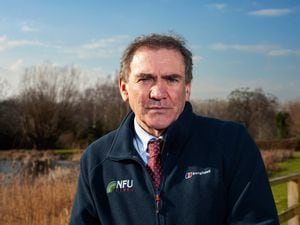

Steven Corfield is a partner and agricultural specialist at Shropshire law firm, FBC Manby Bowdler LLP.